Dependent Life Insurance – What is it, and Should You Have it?

4.9 (582) In stock

Dependent Life insurance provides employees with a lump sum of money in the tragic event that one of their covered dependents passes away.

Dependent Life insurance provides employees with a lump sum of money in the tragic event that one of their covered dependents passes away, providing peace of mind for employees.

We help working Canadians obtain, understand, and access benefits.

Benefits by Design's Embedded Enhancements & Value-Added Benefits

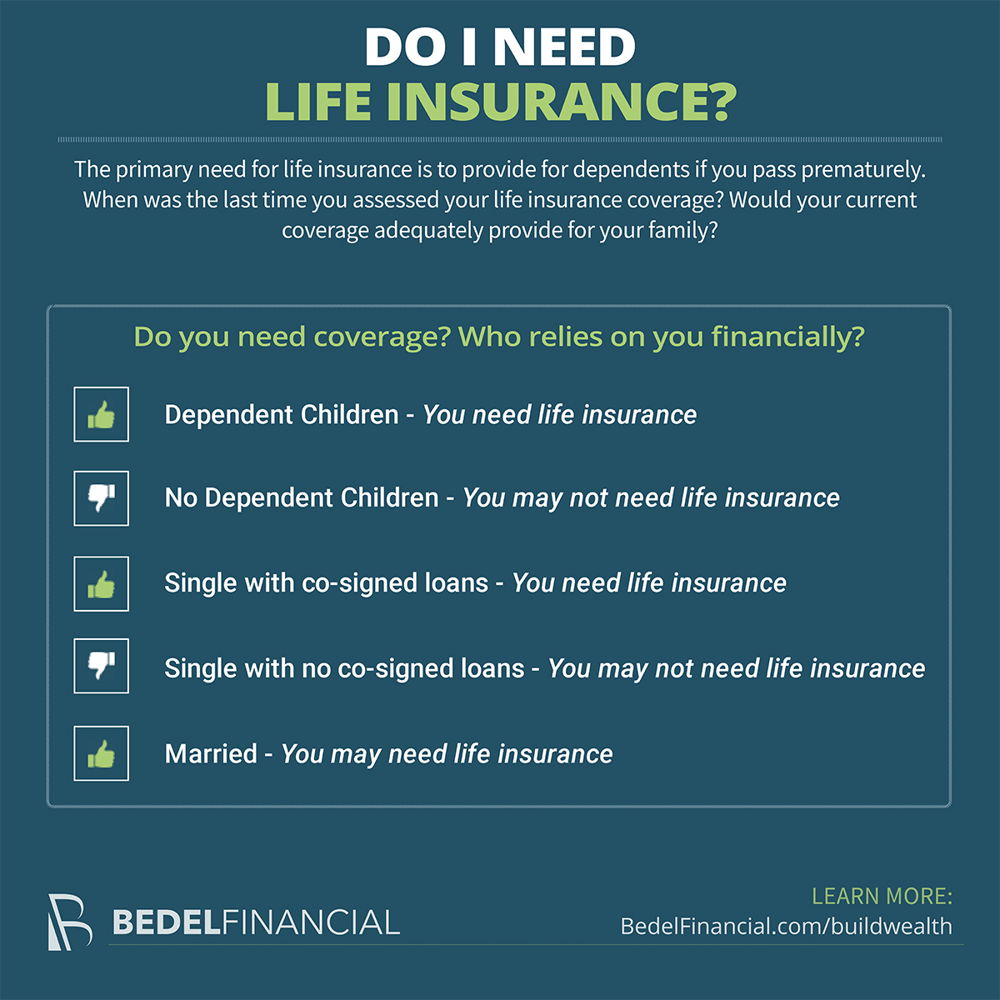

Do I Need Life Insurance?

:max_bytes(150000):strip_icc()/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)

What Is a Qualifying Life Event?

Understanding Voluntary Life Insurance: What to Know

How to Read and Understand Your Schedule of Benefits

How Much Life Insurance Do I Need? [Jan. 2024] - PolicyAdvisor

Should I Get Life Insurance Through Work? Is It Enough?

Dependent Life Insurance – What is it, and Should You Have it?

BenefitsCaterpillar

What Is Dependent Life Insurance?

Infographic: Term Life vs Whole Life Insurance - Low Cost Life Insurance

How to Read and Understand Your Schedule of Benefits

What Is Dependent Life Insurance Coverage? Explained Simply

What Is Dependent Life Insurance Coverage? Explained Simply

What is a whole of life insurance policy?

Buying Life Insurance with Epilepsy (4 things you need to know) - The Defeating Epilepsy Foundation

Top Life Insurance Statistics for 2024

What Is a Life Insurance Agent and Do You Need One? - Ramsey

3 Pack: Mens Pajama Pants – Mens Fleece Plaid Lounge Pajama Bottoms(Available in Big & Tall), Set D, Large : : Clothing, Shoes & Accessories

3 Pack: Mens Pajama Pants – Mens Fleece Plaid Lounge Pajama Bottoms(Available in Big & Tall), Set D, Large : : Clothing, Shoes & Accessories- Paramour Women's Marvelous Side Smoother Bra - Fuchsia Rose 40ddd

Why the UK is the right market for Honey Birdette

Why the UK is the right market for Honey Birdette/product/82/292518/1.jpg?6437) Fashion Girl Underwear 4 Pcs / Lot Cute Cotton Panties @ Best

Fashion Girl Underwear 4 Pcs / Lot Cute Cotton Panties @ Best Self titled album has been removed. Top comment is removed next : r/Paramore

Self titled album has been removed. Top comment is removed next : r/Paramore Bliss French Cut Panty - Black - Chérie Amour

Bliss French Cut Panty - Black - Chérie Amour