10-year Treasury yield dips to new 2016 lows further below 2%

4.7 (693) In stock

.1562153928810.png?w=929&h=523&vtcrop=y)

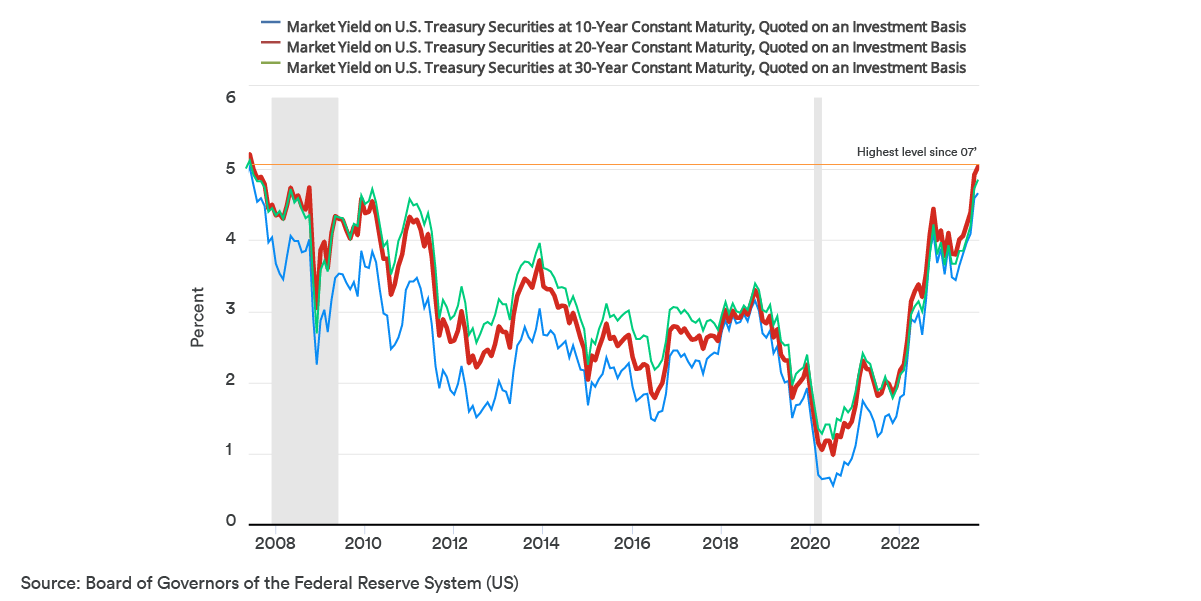

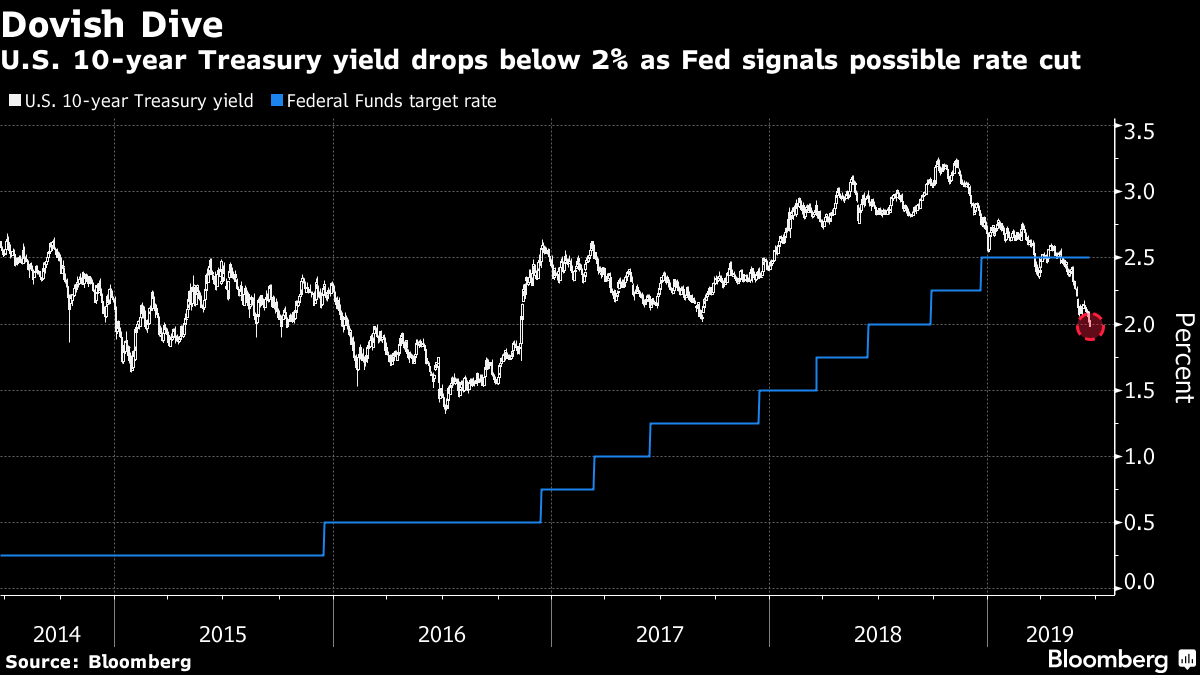

The yield on the benchmark 10-year Treasury note fell to its lowest level since November 2016 on Wednesday, continuing its slide below 2%.

2 Markets 2 Different Tales - Leverage Shares

Treasury 10-Year Yield Slides Below 2% to Lead Global Decline - Bloomberg

Stock market today: Live updates

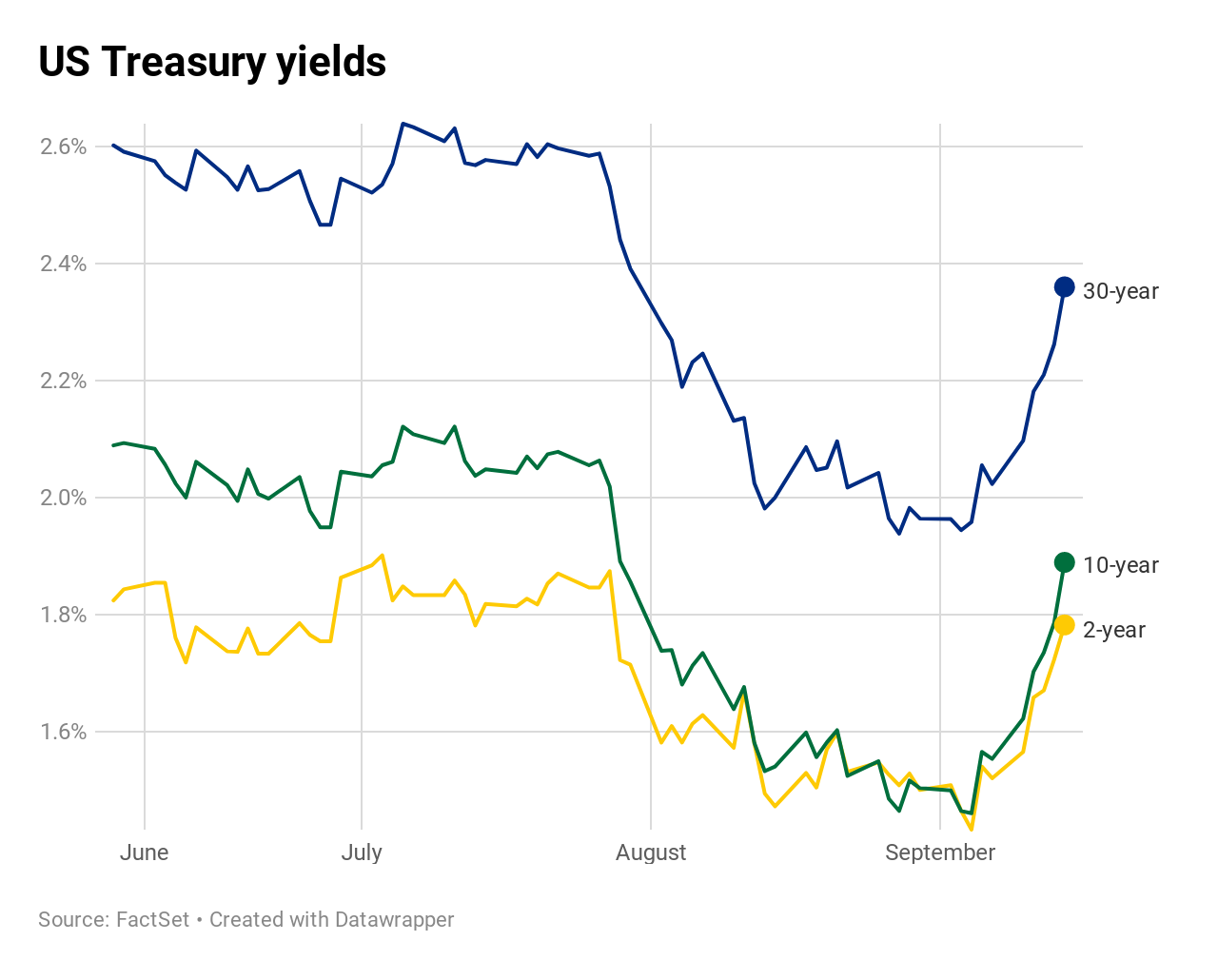

How true is it when Yield spread on US 2-year and 10-year treasuries is getting flat. When it inverts, history says a recession usually follows? - Quora

Deep Dive: The inverted Treasury yield curve – Is it different this time? - PitchBook

10-year yield surges the most in a week since 2016

US 30-year bond yield falls below 2% for first time

The Budget and Economic Outlook: 2024 to 2034

Explainer: U.S. yield curve inversion - What is it telling us?

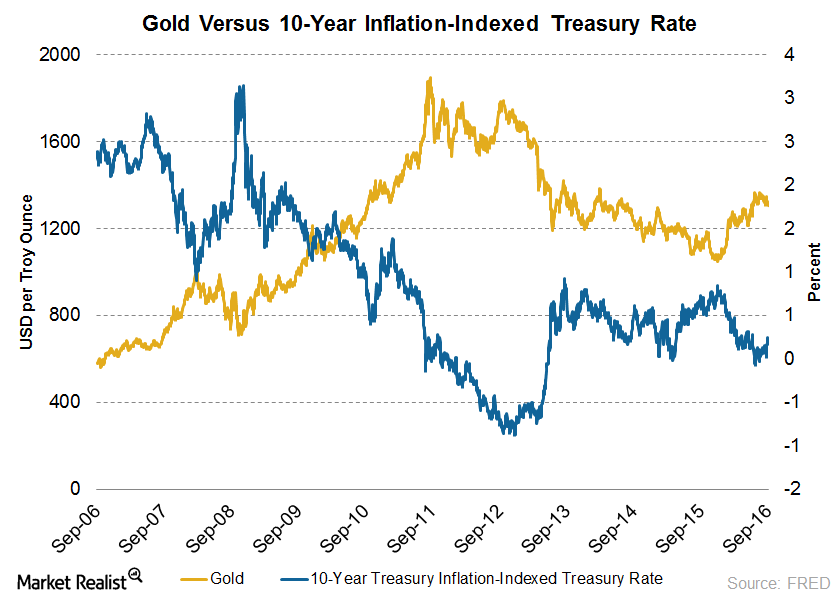

Pensions Swamped in a Sea of Negative Real Rates

2020 stock market crash - Wikipedia

Weekly Market Commentary

Gold versus 10-Year Treasury Bonds

Recession curve analysis: a Nanto spring recession curve evaluated in

The Complete Storyline Of Curve (2016)

Eastbound Pennsylvanian on Horseshoe Curve, 2016. — Amtrak: History of America's Railroad

Opinion Why We Should Stop Grading Students on a Curve - The New York Times

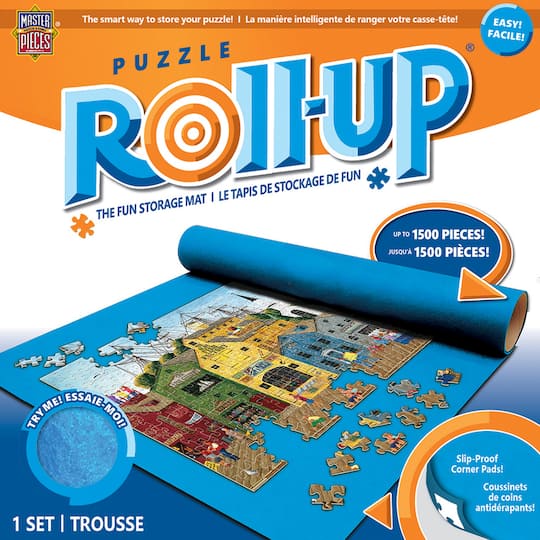

MasterPieces® Roll-Up® Puzzle Storage Mat

MasterPieces® Roll-Up® Puzzle Storage Mat Underwear Coupons, Promo Codes March 2024

Underwear Coupons, Promo Codes March 2024 Neoprene Thigh Sleeve Support

Neoprene Thigh Sleeve Support Embroidered lace panties transparent sexy low waist underwear ladies girls soft breathable briefs

Embroidered lace panties transparent sexy low waist underwear ladies girls soft breathable briefs Pastafarian can wear strainer on head in license photo

Pastafarian can wear strainer on head in license photo Sunday Sleep Ultra-Soft Cami Pajama Top for Women

Sunday Sleep Ultra-Soft Cami Pajama Top for Women