What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

4.6 (759) In stock

Determining the Date of Assessment for IRS Collection Purposes - CPA Practice Advisor

IRS Liens - Here's What They Are and How They Impact You.

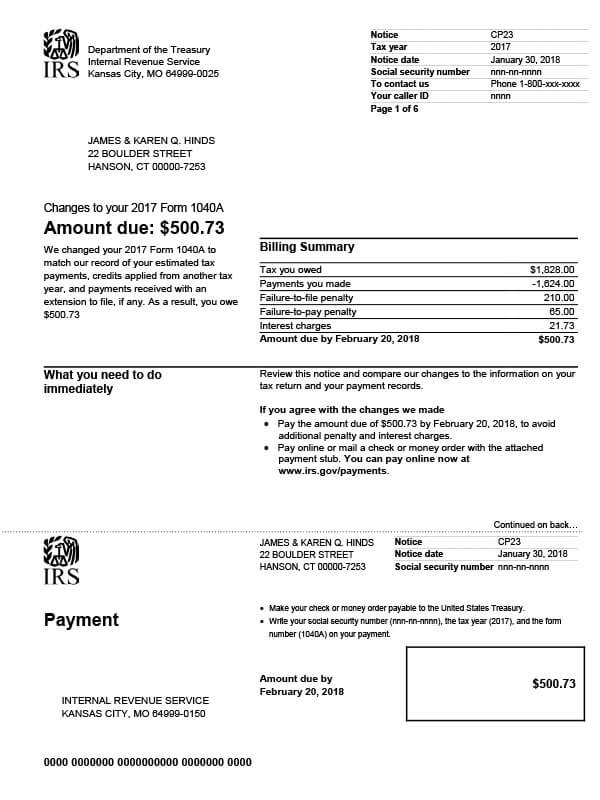

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

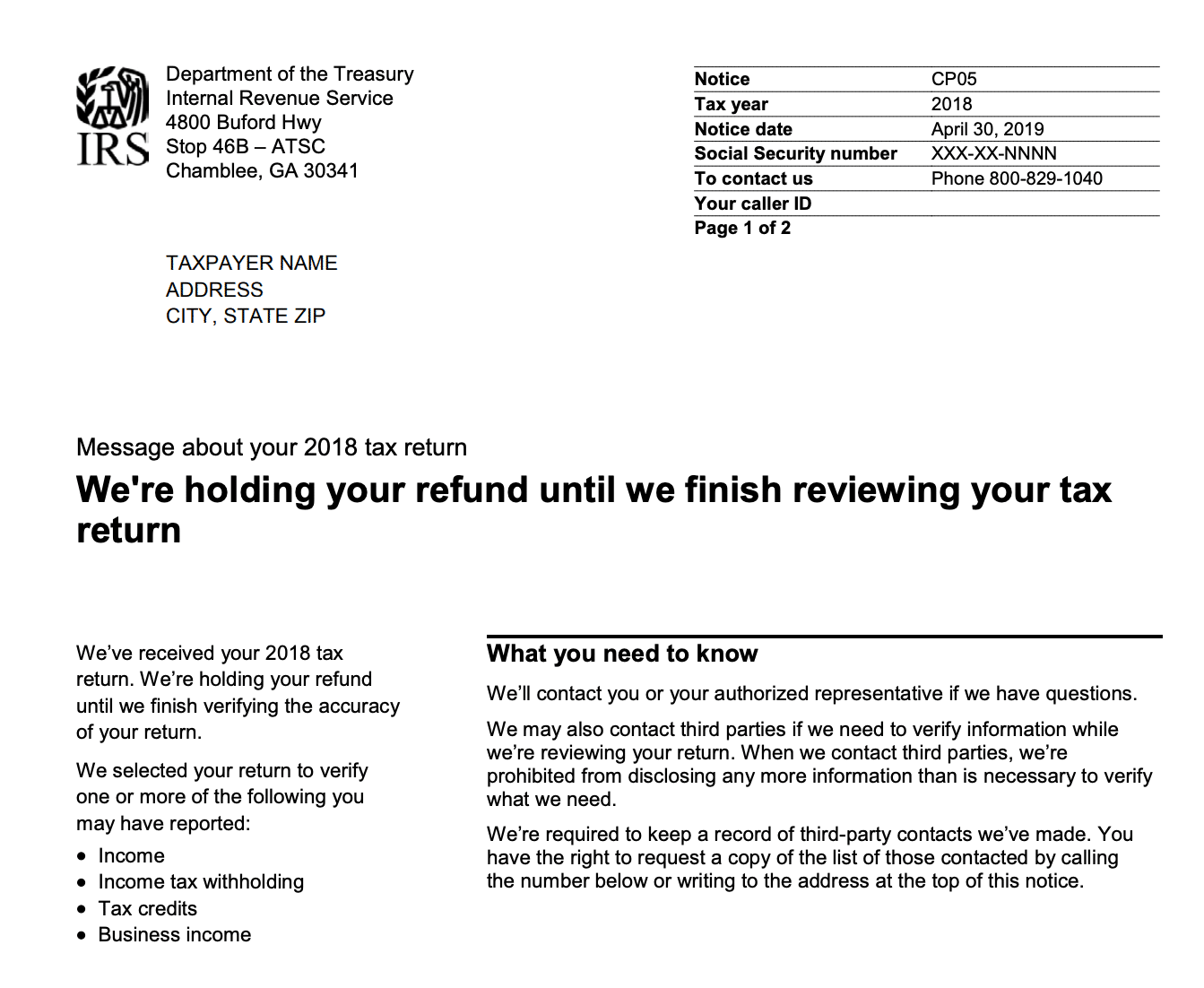

Millions of Americans will receive important IRS letter this month - why ignoring it could cost you

What Is a CP05 Letter from the IRS and What Should I Do?

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

Online account frequently asked questions

IRS Notice CP23 - Tax Defense Network

Contact us - Taxpayer Advocate Service

TAS Tax Tip- Notice from IRS Something wrong with 2022 tax return

A guide to dealing with today's IRS

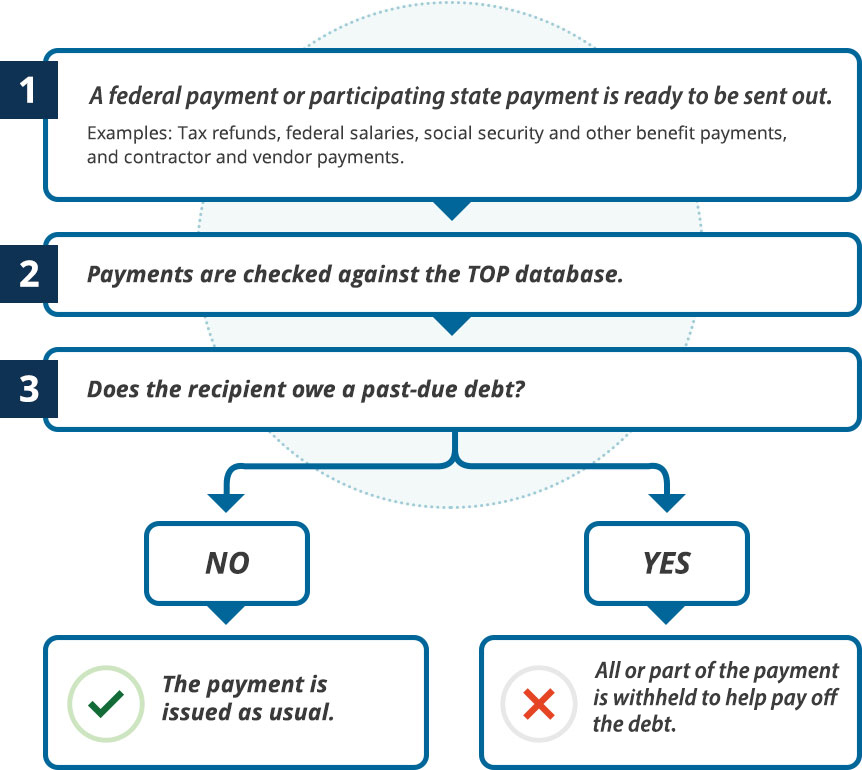

Treasury Offset Program

IRS Letter 3219: What To Do When the IRS Sends You a Notice of Deficiency - Choice Tax Relief

Got a threatening letter, intent to seize your assets, don't panic, help is on the

If you have a problem, give these guys a call Poster for Sale by DafyddEm

Thomas Jefferson Quote: “If you want something you have never had, you must be willing to

How to tell if you have an Intel-based Mac or a Mac with Apple silicon

How to Advocate for Yourself at the Doctor's Office as a Fat Person

If You Have Non-small Cell Lung Cancer, Non-small Cell Lung Cancer Guide

Get the Best Barre Workout for Strength and Tone With These 8 Apps

Get the Best Barre Workout for Strength and Tone With These 8 Apps 1580- Dream Kurves Seamless Underbust Body Shaper in Boy Short

1580- Dream Kurves Seamless Underbust Body Shaper in Boy Short- Stradivarius wide leg sweatpants in black

Tendencias primavera verano 2023 en ZARA España

Tendencias primavera verano 2023 en ZARA España Vegan Designer Stella McCartney Releases Sustainable Adidas Collection

Vegan Designer Stella McCartney Releases Sustainable Adidas Collection Dragon Shield: Perfect Fit Sealable Toploader Sleeves (100, Smoke

Dragon Shield: Perfect Fit Sealable Toploader Sleeves (100, Smoke