Form 990: Five Common Mistakes and How to Avoid Them, Marcum LLP

4.8 (395) In stock

Organizations should take the time to prepare for and carefully review their Form 990, seeking assistance from a tax professional as needed.

Organizations should take the time to prepare for and carefully review their Form 990, seeking assistance from a tax professional as needed.

Managed Accounting Services, Marcum LLP

Friedman LLP on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them

Most Common Nonprofit Form 990 Mistakes

Streamline Employee Expense Reimbursement with Expensify and QBO, Marcum LLP

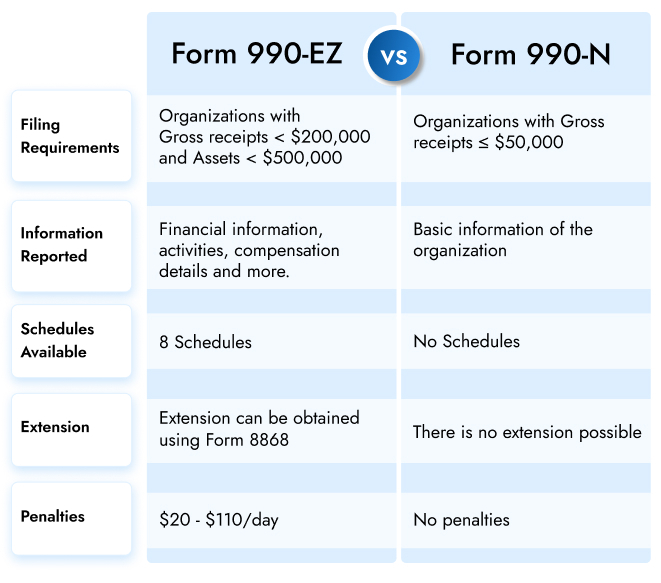

990-N vs 990-EZ Difference Between Form 990-N and 990-EZ

Common Form 990 Mistakes

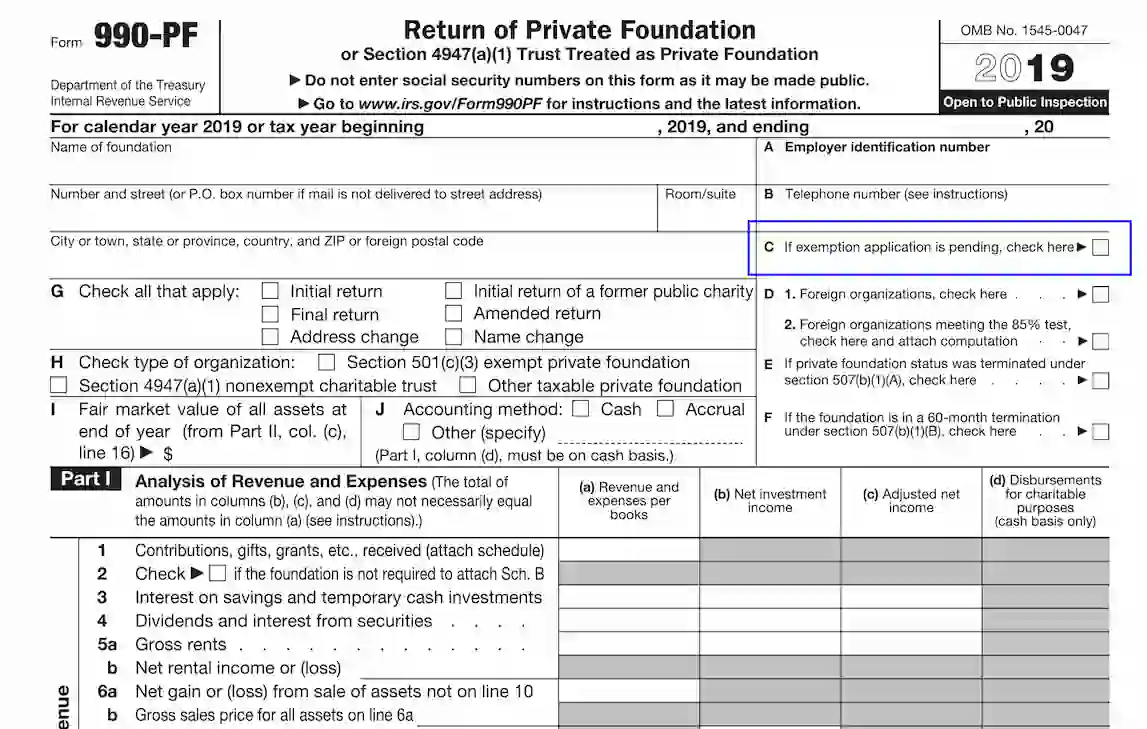

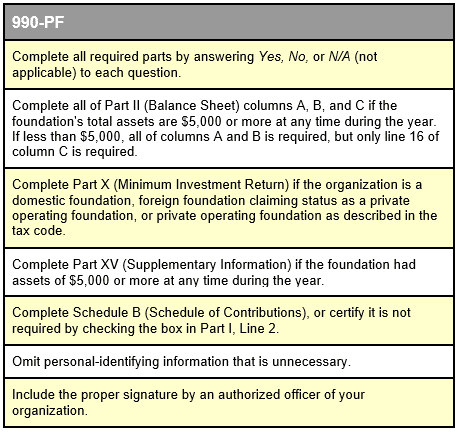

IRS Form 990-PF ≡ Fill Out Printable PDF Forms Online

What is Form 990-PF?

Support FAQs on Form 990 Series and Other Nonprofit Forms

What Are the Most Common Form 990 Mistakes Nonprofits Make? - GRF CPAs & Advisors

Friedman LLP on LinkedIn: Form 990: Five Common Mistakes and How to Avoid Them

Form 990: The Board Member's Guide [Infographic] - RKL LLP

5 Common Mistakes in Supply Chain Management - 3PL Links

Common Mistakes in Vue.js - Vue School Articles

10 Common Mistakes in Logo Design and How To Avoid Them - Zeka Design

Top 5 Most Common Driving Mistakes to Avoid

English Clubbers on X: The most common mistakes Learn English / X

- LEVIS Levis Jeans Regular Fit Hombre

- Pepe Jeans London - This is the kind of underwear you'll want to

Pearl Izumi Womens Sugar Thermal Cycling Tight

Pearl Izumi Womens Sugar Thermal Cycling Tight Design Veronique Allyssandra 2 Band Cotton Knit Bra #454

Design Veronique Allyssandra 2 Band Cotton Knit Bra #454/product/44/0485021/1.jpg?5012) Shop Generic Women Print Denim Yoga Pant Sport Casual Jeans Leggings Girl Plus Size Elastic Slim Pants High Waist Tights Fitness Gym Clothing(#1604 denim) Online

Shop Generic Women Print Denim Yoga Pant Sport Casual Jeans Leggings Girl Plus Size Elastic Slim Pants High Waist Tights Fitness Gym Clothing(#1604 denim) Online Molaro joint the PR FESR 2021-2027. - Molaro

Molaro joint the PR FESR 2021-2027. - Molaro