Tax Credits for Individuals and Families

4.8 (497) In stock

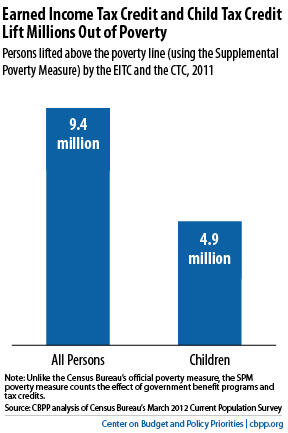

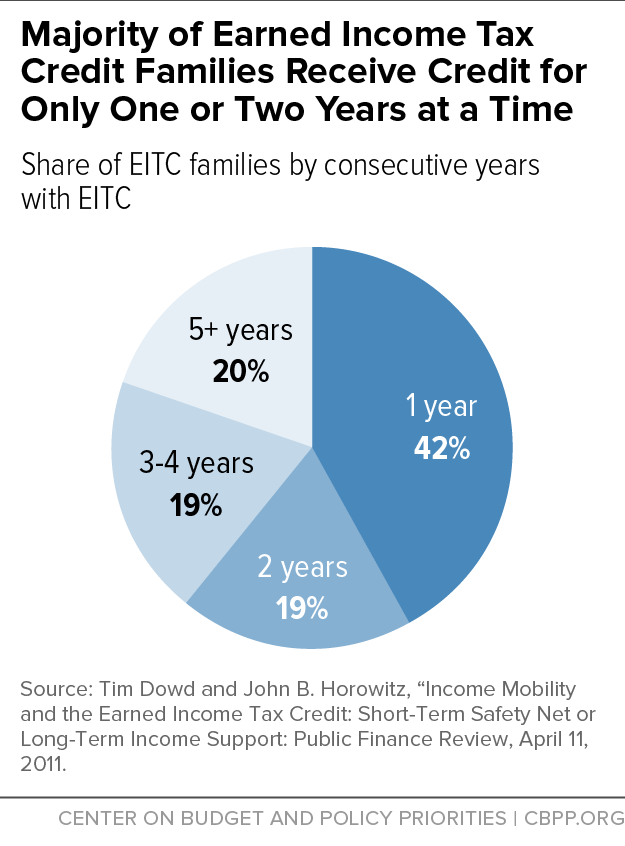

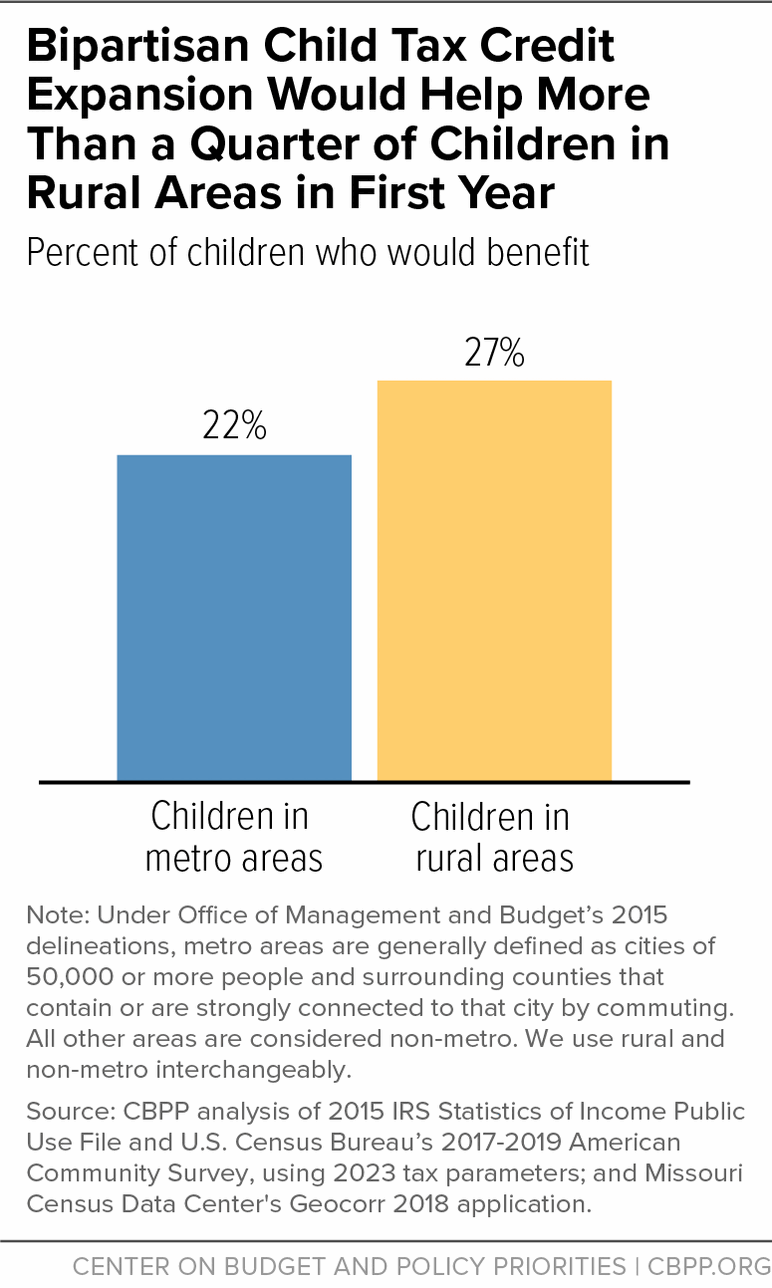

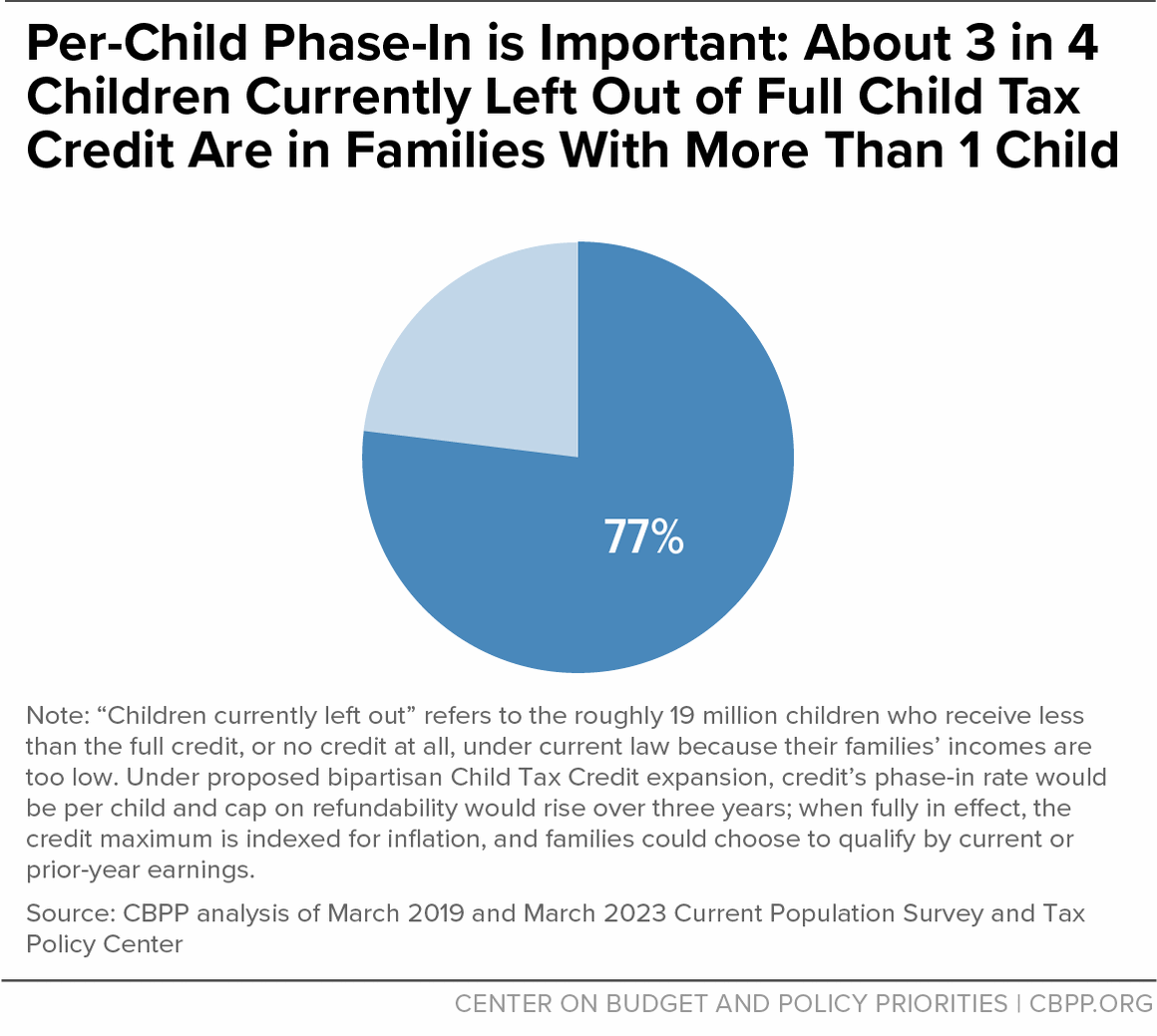

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

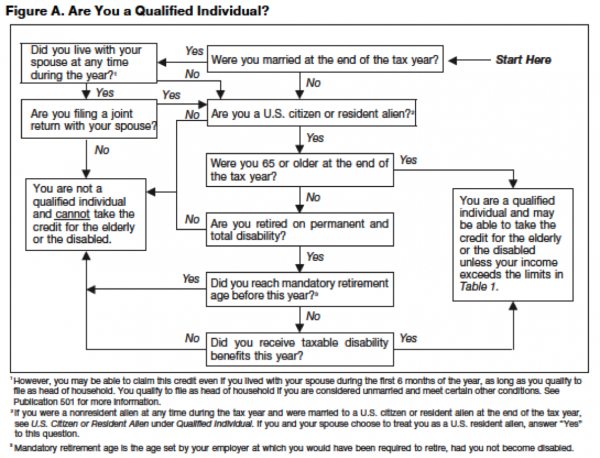

Population-Specific EITC Considerations and Programs

Important Improvements to Two Key Tax Credits, Explained

Approaches, costs and benefits differ among various health-reform

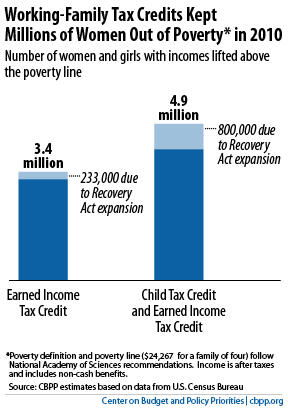

Tax Credits for Working Families Help Women Now and Later

Tips to deal with postpartum depression

Taxes: Tax Implications of Whole Life Cost: What You Need to Know

EITC and Child Tax Credit Promote Work, Reduce Poverty, and

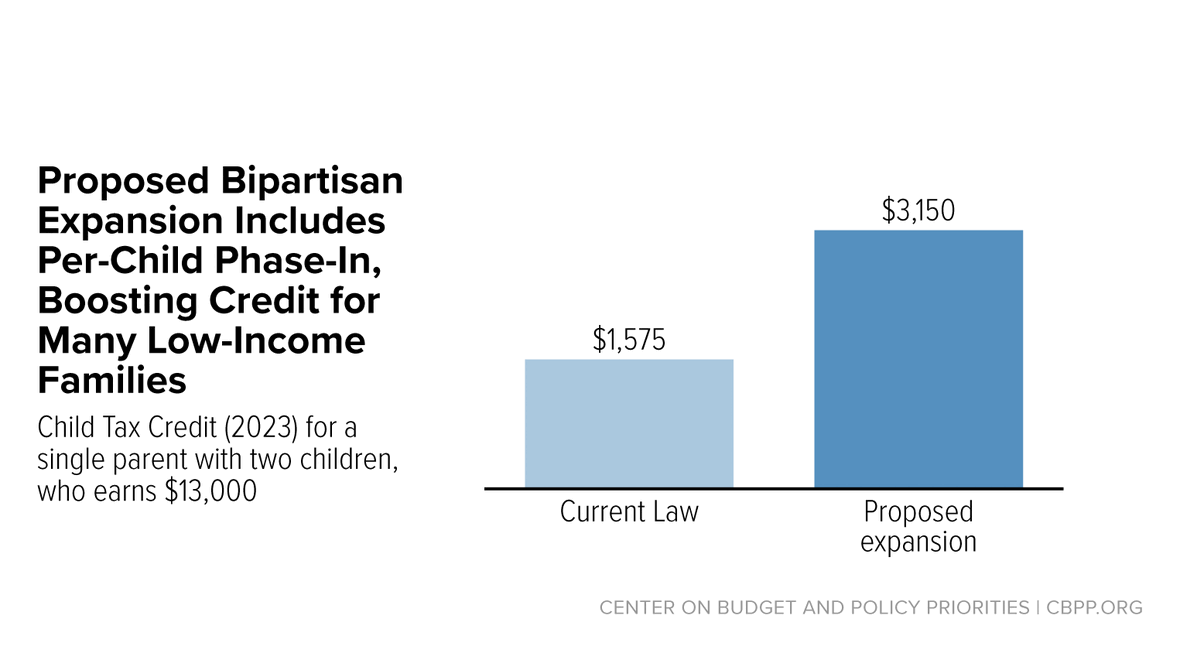

House-Passed Bipartisan Tax Bill's Child Tax Credit Expansion

Temporarily Expanding Child Tax Credit and Earned Income Tax

About 16 Million Children in Low-Income Families Would Gain in

Federal Tax Credit - FasterCapital

Resources For Individuals And Families - FasterCapital

Higher cost of finance exacerbates a climate investment trap in developing economies

6 Reasons For Low Profitability and Margins In Business

3 Ways to Permanently Lower Your Voice - wikiHow

Under Armour Women's Breathe Lite Ultra Low Socks, Multipairs

Womens Jeggings with Pockets Ripped High Waisted Classic Totally Shaping Slim Fit Denim Pencil Pants Tights at Women's Jeans store

Womens Jeggings with Pockets Ripped High Waisted Classic Totally Shaping Slim Fit Denim Pencil Pants Tights at Women's Jeans store Gold Candle Holder Candelabra Centerpieces for Tables - 23.6 Tall

Gold Candle Holder Candelabra Centerpieces for Tables - 23.6 Tall Strappy Lace Padded Bralette / Crop Top by Wishlist- Golden

Strappy Lace Padded Bralette / Crop Top by Wishlist- Golden Happy Promise Day 2024 wishes: Images, quotes, greetings and

Happy Promise Day 2024 wishes: Images, quotes, greetings and Blissful Benefits by Warners® Womens No Muffin Top Zambia

Blissful Benefits by Warners® Womens No Muffin Top Zambia JoJo Siwa Girls 2-piece Bundle Set Bow Bow, Unicorns Sizes 4-16 T-Shirt, Multi, 7-8 US

JoJo Siwa Girls 2-piece Bundle Set Bow Bow, Unicorns Sizes 4-16 T-Shirt, Multi, 7-8 US