Who is a 'Person' under S. 2(31) of Income Tax Act in India

4.7 (521) In stock

Find out what constitutes a 'person' under Section 2(31) of the Income Tax Act in India and what it means for tax purposes.

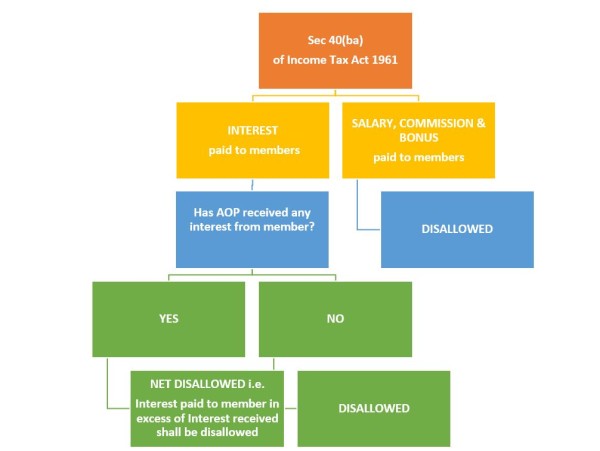

Taxation of Association of Persons

CDC Museum COVID-19 Timeline, David J. Sencer CDC Museum

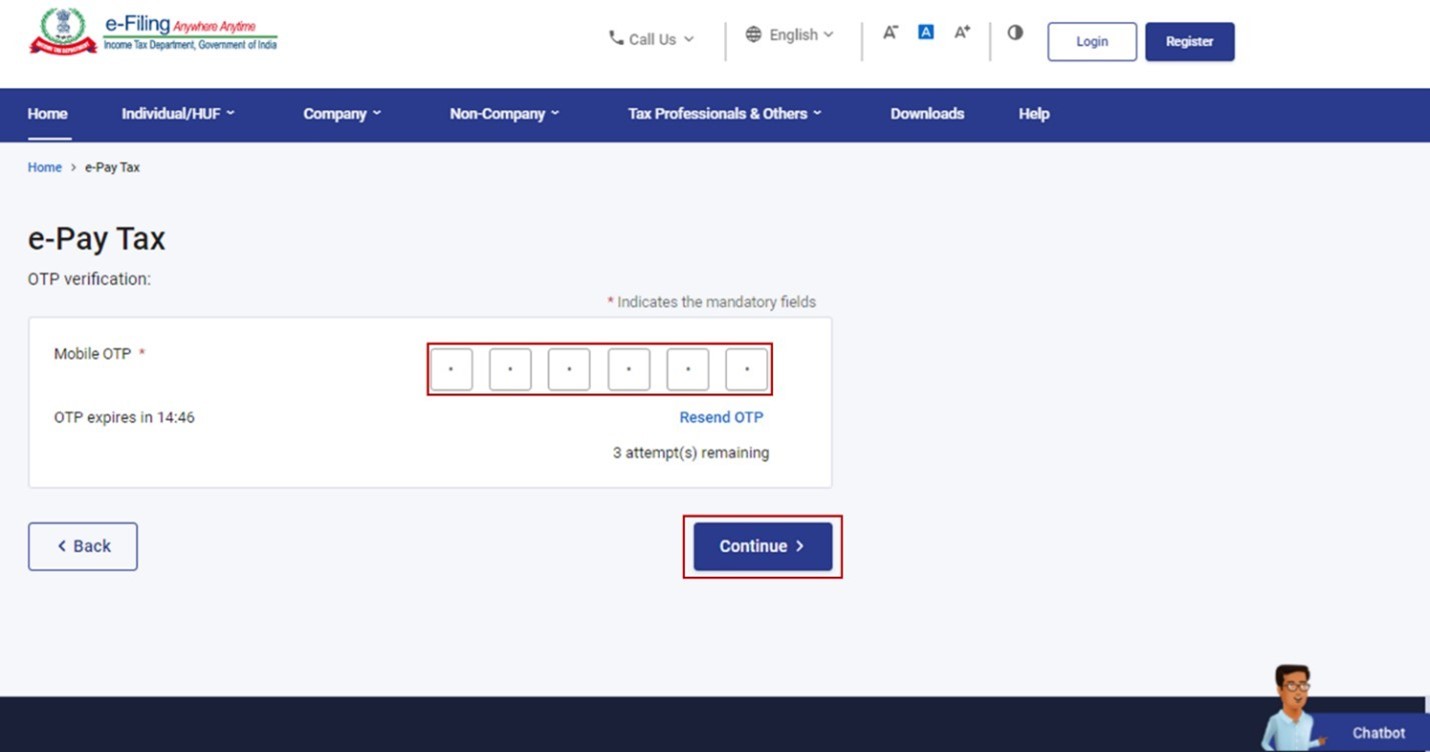

How to Generate Challan Form User Manual

Definitions in Income Tax Act 1961 with MCQs - Deep Gyan®

Definition of Persons under Income Tax Act 1961» Legal Window

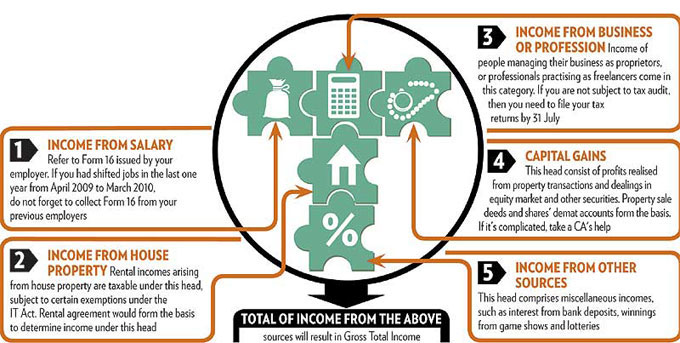

5 heads of income in the Indian Income Tax Act

Definitions in Income Tax Act 1961 with MCQs - Deep Gyan®

SOLUTION: 005 major elective i income tax law practice i v sem - Studypool

SOLUTION: Income tax introduction - Studypool

Less vs. Fewer: Difference between Fewer vs. Less (with Useful

Less Than Symbol- Meaning and Examples

Nothing New Under The Sun': Meaning & Context Of Phrase ✔️

Ifluent English - ⚊ Phrasal Verb: look down on (sb) ⚊ Meaning

Ropa De Dormir Mujer

Ropa De Dormir Mujer Guide Gear Men's Fleece-lined Flex Canvas Cargo Work Pants

Guide Gear Men's Fleece-lined Flex Canvas Cargo Work Pants real talk spotted some Trend Trendy Outfits Clothes Style

real talk spotted some Trend Trendy Outfits Clothes Style SB Dunk Low Pro 'Wheat' release date

SB Dunk Low Pro 'Wheat' release date Fleece Lined Leggings Women Solid Color Winter Warm Thermal - Temu Canada

Fleece Lined Leggings Women Solid Color Winter Warm Thermal - Temu Canada Athleta, Pants & Jumpsuits, Nwot Athleta Elation Rib Crop Flare

Athleta, Pants & Jumpsuits, Nwot Athleta Elation Rib Crop Flare