Low-Income Housing Tax Credits

4.5 (202) In stock

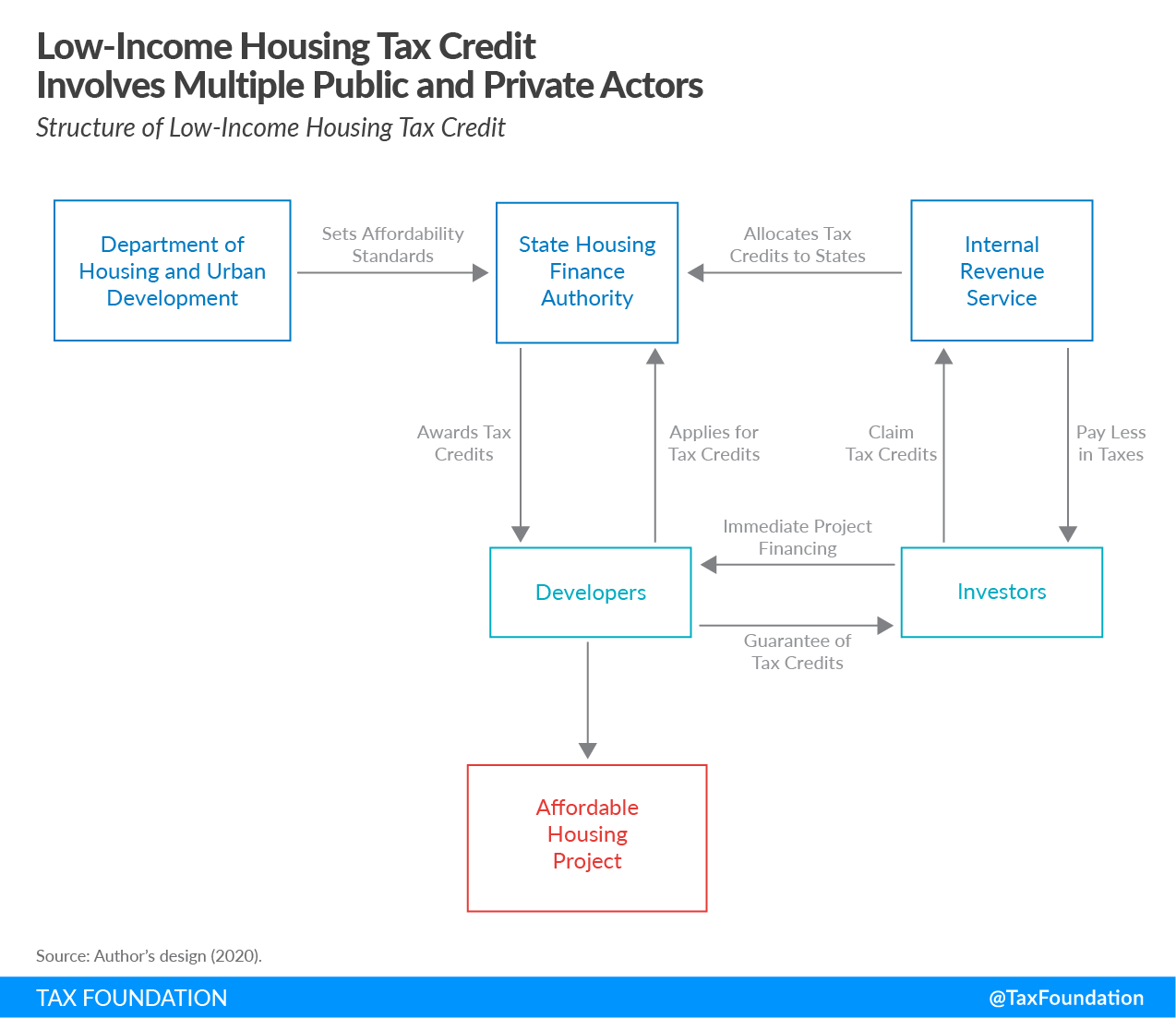

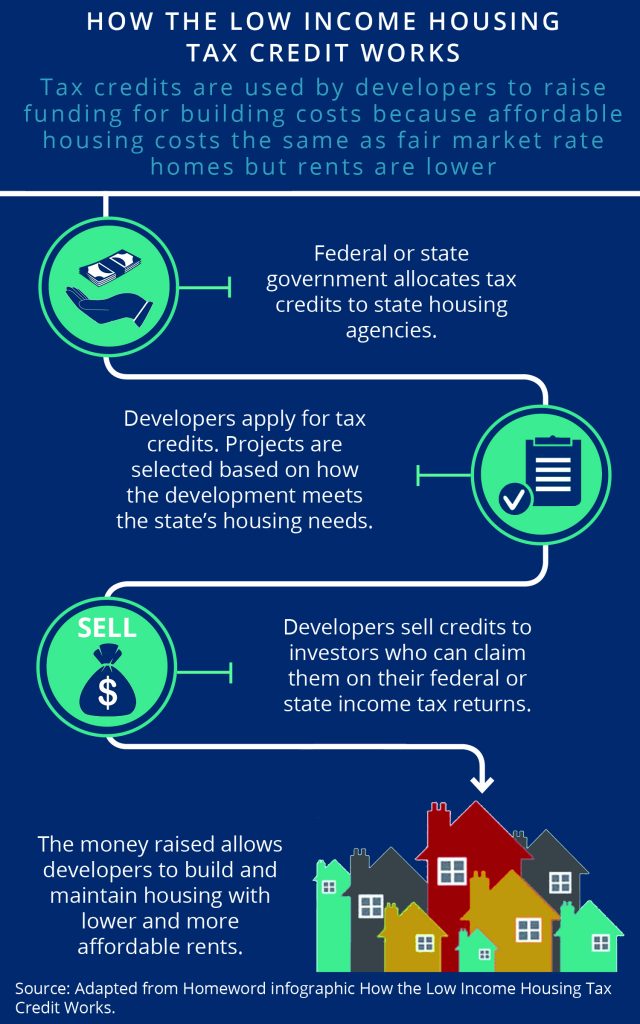

The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

Making the Most of the Low Income Housing Tax Credit for Veterans

When developers seek financial resources for affordable rental housing development, many combine funds generated through the Low-Income Housing Tax

HOME and the Low-Income Housing Tax Credit Guidebook: Urban

Low Income Housing Tax Credit Ppt Powerpoint Presentation

How affordable housing can chip away at residential segregation

Texas Awards $67 Million in LIHTCs

Low-Income Housing Tax Credits

Conceptual Business Illustration with the Words Low-income Housing

Biden Infrastructure Plan Calls for Housing Credit Expansion – The Affordable Housing Tax Credit Coalition

Low-Income Housing Tax Credit (LIHTC): Details & Analysis

State and Local Strategies to Improve Housing Affordability

HWA #HWAA #HUD #Housing #Urban #Development #Low-income #Housing

Missouri awards over $40 million in low-income housing tax credits • Missouri Independent

LIHTC101: What Developers Need to Know About the Low-Income Housing Tax Credit Program – Ramaker and Associates

Low-Income Housing Tax Credit (LIHTC) Program

Low income - Free business and finance icons

Low income senior housing in tennessee

How to Get Out of Debt on a Low Income - Ramsey

$84,000 a year now qualifies as low income in high-cost Orange County – Orange County Register

Wacoal At Ease Shaping Camisole with built in bra 802310

Wacoal At Ease Shaping Camisole with built in bra 802310 I Worked Out at a Women-Only Gym to See If I'd Feel More

I Worked Out at a Women-Only Gym to See If I'd Feel More DailyWear Womens Push Up Bra Various Styles (Pack of 6) (4370PU

DailyWear Womens Push Up Bra Various Styles (Pack of 6) (4370PU The 2 Best 32-Inch TVs of 2024

The 2 Best 32-Inch TVs of 2024- Plus Size - Full-Coverage Balconette Lightly Lined Smooth 360° Back Smoothing™ Bra - Torrid

Men Skinny Cargo Combat Denim Jeans Casual Slim Fit Pants Trousers(black)

Men Skinny Cargo Combat Denim Jeans Casual Slim Fit Pants Trousers(black)