Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

4.9 (769) In stock

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

How a Tax Incentive for Clean Energy in the Inflation Reduction Act Could Affect Low-Income Communities

Congress May Expand The Low-Income Housing Tax Credit. But Why

The economic impact of housing insecurity in the United States

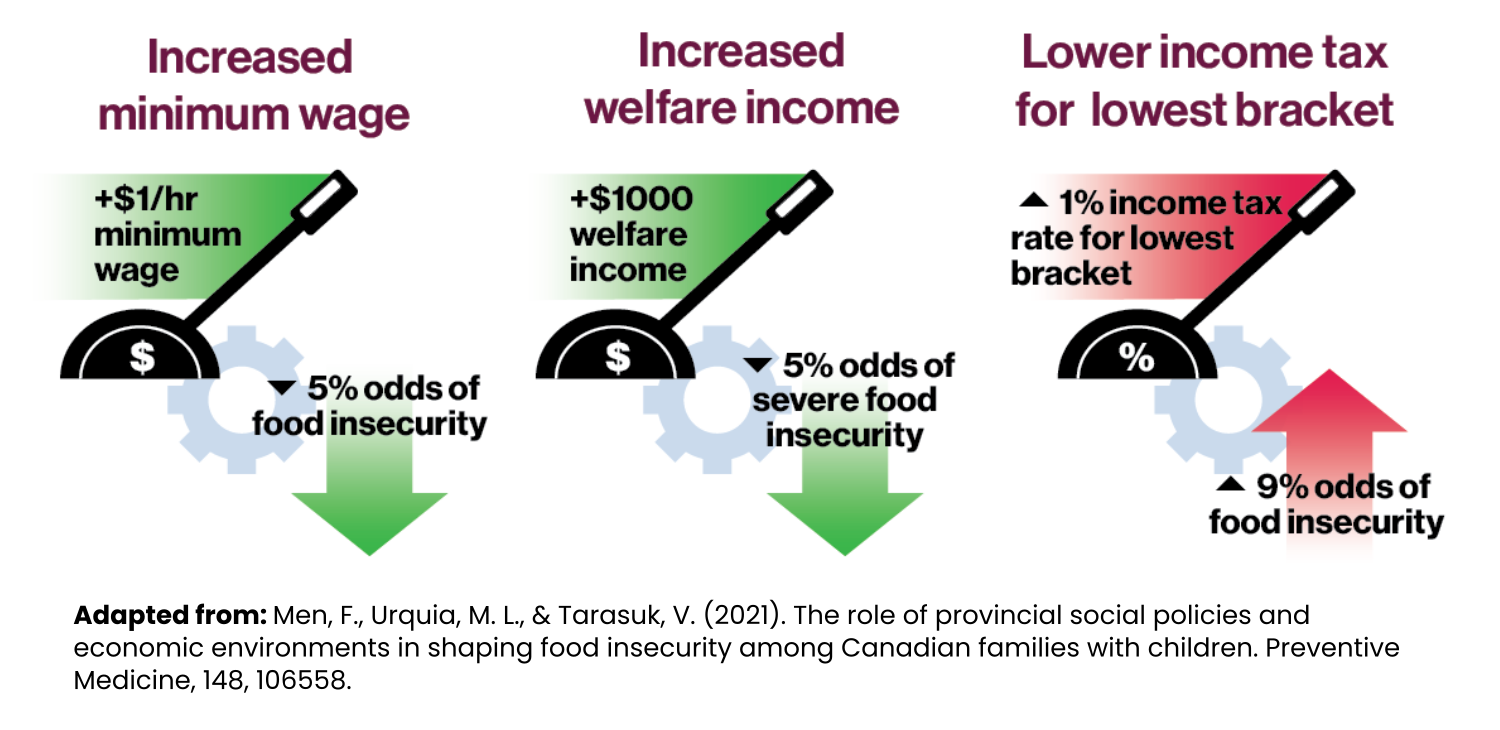

What can be done to reduce food insecurity in Canada? - PROOF

/cdn.vox-cdn.com/uploads/chorus_image/image/62240275/sf_transamerica_full_ca.0.1541712600.0.jpg)

Everything you need to know about the affordable housing debate - Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/24937557/GettyImages_1358862098.jpg)

Child poverty's historic drop and rebound, explained in one chart

We Deserve to Have a Place to Live”: How US Underfunding Public

AHTCC Applauds Low-Income Housing Tax Credit Provisions in Wyden-Smith Tax Proposal – The Affordable Housing Tax Credit Coalition

The New Social Housing - Harvard Design Magazine

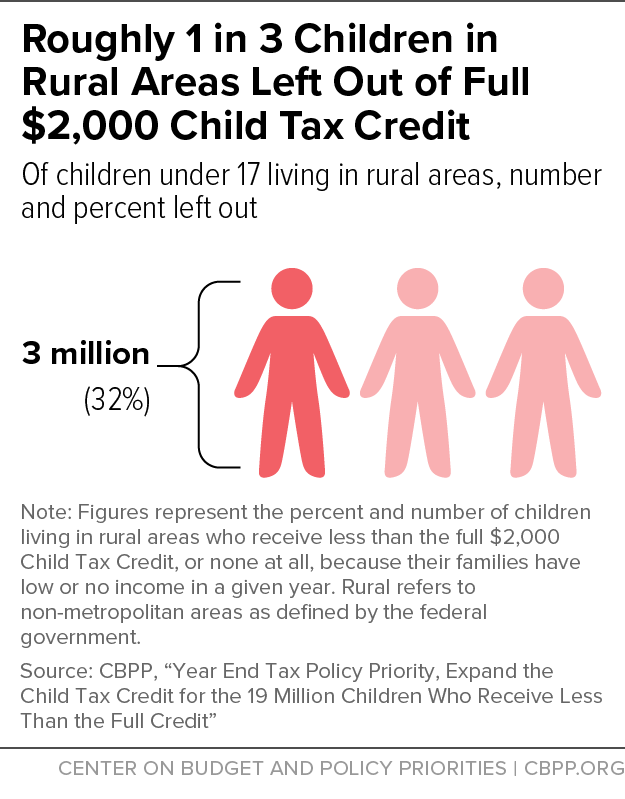

Child Tax Credit Expansion Is Especially Important to Rural

Congress proposes child tax credit increase for 2024

Obstacles for low-income patients

Low income - Free business and finance icons

Infographic: Inequalities in children in low income families in

A backgrounder on poverty in Canada

Basic Facts about Low-Income Children: Children under 18 Years, 2014 – NCCP

Helly Hansen Daybreaker Fleece Jacket in Gray for Men

Helly Hansen Daybreaker Fleece Jacket in Gray for Men Top 5 Underwear Materials We Recommend Having In Your Panty Drawer - Different Underwear Materials & Why They Matter

Top 5 Underwear Materials We Recommend Having In Your Panty Drawer - Different Underwear Materials & Why They Matter STICKY BE SOCKS : The Fondle Project Collection

STICKY BE SOCKS : The Fondle Project Collection White Plush Carpet Yoga Mat Bedside Foot Pad Imitation Wool Carpet/

White Plush Carpet Yoga Mat Bedside Foot Pad Imitation Wool Carpet/ YOKWI Wireless Bras for Women 36a Women Thread Sling Wrap Breast

YOKWI Wireless Bras for Women 36a Women Thread Sling Wrap Breast- Plus Size - Open Back Cheeky Panty - Satin & Lace Bow Red - Torrid