Andorra Tax Rates: a Complete Overview of the Andorra Taxation for

5 (746) In stock

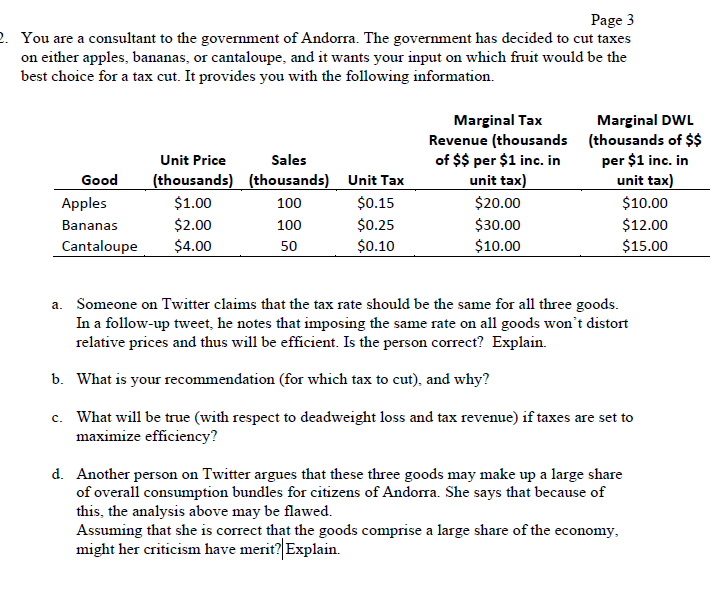

Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

The Full 2024 Guide to Andorra Taxes

Best Countries With the Lowest Taxes for Expats to Consider

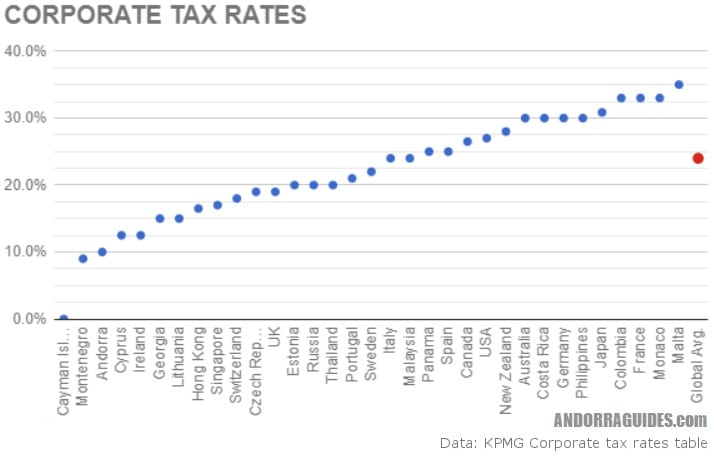

Solved Page 3 2. You are a consultant to the government of

a.storyblok.com/f/176292/1536x864/c372a76710/andor

12 Countries with The Lowest Taxes in Europe: 2024 Tax Guide

Corporate Tax Laws and Regulations, Andorra

Taxation in Andorra: one of the most favourable in Europe

Lexington Ski & Sports Club - 2021 International Trip

Andorra - The World Factbook

Living & Thriving in Andorra: A Guide for Expats — Flourish In The Foreign

The Andorra Tax System

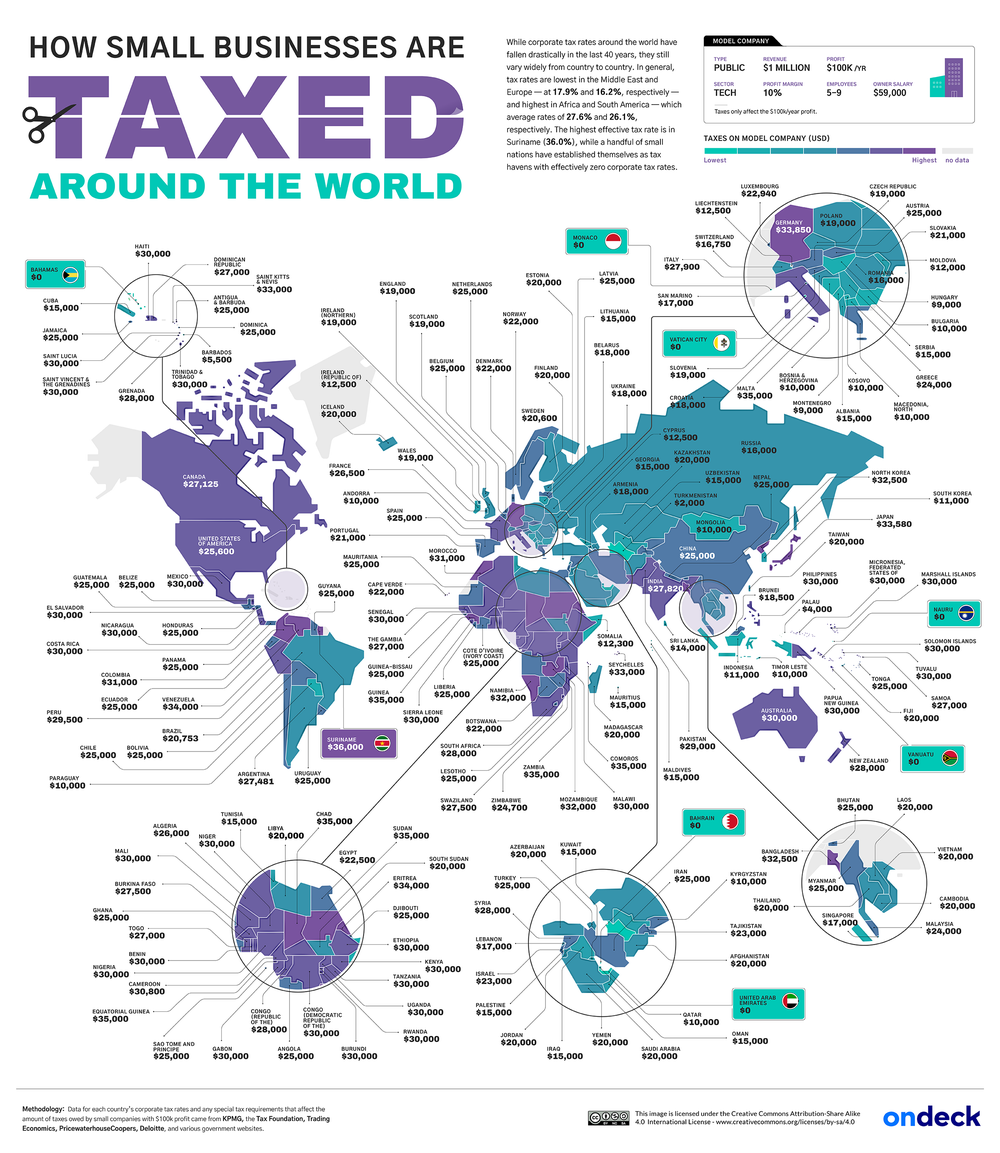

Taxes on Small Businesses Across the Globe, Mapped: See Where Rates Are High, Low — and Nonexistent

Andorra - Souvenirs d'Andorre l'hiver, chien , carte postale neuve, non circulée.

Andorra to renounce banking secrecy as it sheds tax haven status, Andorra

Panache Women's 36DD Bra Andorra Non Wire Unlined Beige Nude Full Cup EUC

ANDORRA OFFSHORE BANK ACCOUNT FOR NON-RESIDENT 2024

Can you have a company in Andorra and not be a resident of the

Women's Lace Panties Leopard Seamless Underware Slip Ice Silk

Women's Lace Panties Leopard Seamless Underware Slip Ice Silk Nykd by Nykaa Shape up encircled bra with Full coverage - Clay NYB169

Nykd by Nykaa Shape up encircled bra with Full coverage - Clay NYB169- Men's Short Sleeve Performance T-Shirt - All In Motion™ Gray Heather M

30 Great Beach Outfit Ideas and Beach Accessories Summer clothes collection, Style, Summer outfits

30 Great Beach Outfit Ideas and Beach Accessories Summer clothes collection, Style, Summer outfits Rachel Reveals on X: Waiting for cock! need a stiff juicy and

Rachel Reveals on X: Waiting for cock! need a stiff juicy and- Body Up Women's Medium Impact Spacer Underwire Sports Bra - SB30327 36G Black